- #Compare auto insurance rates by zip code drivers

- #Compare auto insurance rates by zip code full

- #Compare auto insurance rates by zip code code

#Compare auto insurance rates by zip code drivers

While not all states require underinsured and uninsured motorist coverage, Minnesota drivers must carry them along with personal injury protection. $50,000 underinsured/uninsured motorist bodily injury coverage per accident.$25,000 underinsured/uninsured motorist bodily injury coverage per person.$10,000 property damage liability per accident.$60,000 bodily injury liability per accident.$30,000 bodily injury liability per person.According to Minnesota law, all drivers must either meet or exceed the following minimum requirements: Liability coverage is the minimum coverage required by the state of Minnesota. Geico is the second-cheapest option in Minneapolis with average rates of $43 per month or $511 per year. USAA offers the cheapest liability insurance with average rates of $40 per month or $485 per year. Cheapest Liability Car Insurance in Minneapolis

#Compare auto insurance rates by zip code full

Similarly, full-coverage insurance costs $180 per month or $2,163 per year on average, which is about 8% more expensive than the national average of $167 per month or $2,008 per year for full coverage. This is about 16% more than the national average of $52 per month or $627 per year. Keywords: Compare Vehicle Insurance, Compare Insurance Rates, Insurance Rates by ZIP Code, Best Insurance Comparison Sites, The Zebra, Insurify,, NerdWallet, Esurance,, Policygenius, CoverHound.Our data shows that the average cost of car insurance for minimum coverage in Minneapolis is $60 per month or $722 per year. By taking the time to compare, you can make an informed decision and save on your vehicle insurance premiums.

#Compare auto insurance rates by zip code code

ConclusionĬomparing vehicle insurance rates by ZIP code and using insurance comparison websites are powerful strategies to find the best coverage at the most affordable price. CoverHound: CoverHound allows you to compare auto insurance rates from top providers and offers personalized advice to help you make the right decision.Įach of these platforms provides an efficient way to compare insurance rates and identify the best policy for your needs.Policygenius: Policygenius simplifies the insurance shopping process by offering unbiased advice and comparison options for various insurance types.: is known for its comprehensive quote comparison tool and the ability to directly purchase your chosen policy.Esurance: Esurance allows you to compare quotes from several companies, with an easy-to-navigate platform and transparent pricing.NerdWallet: NerdWallet not only offers insurance comparison but also provides insightful articles and resources to help you understand your coverage options.: partners with various insurance companies to provide a wide range of quotes for users to compare side by side.

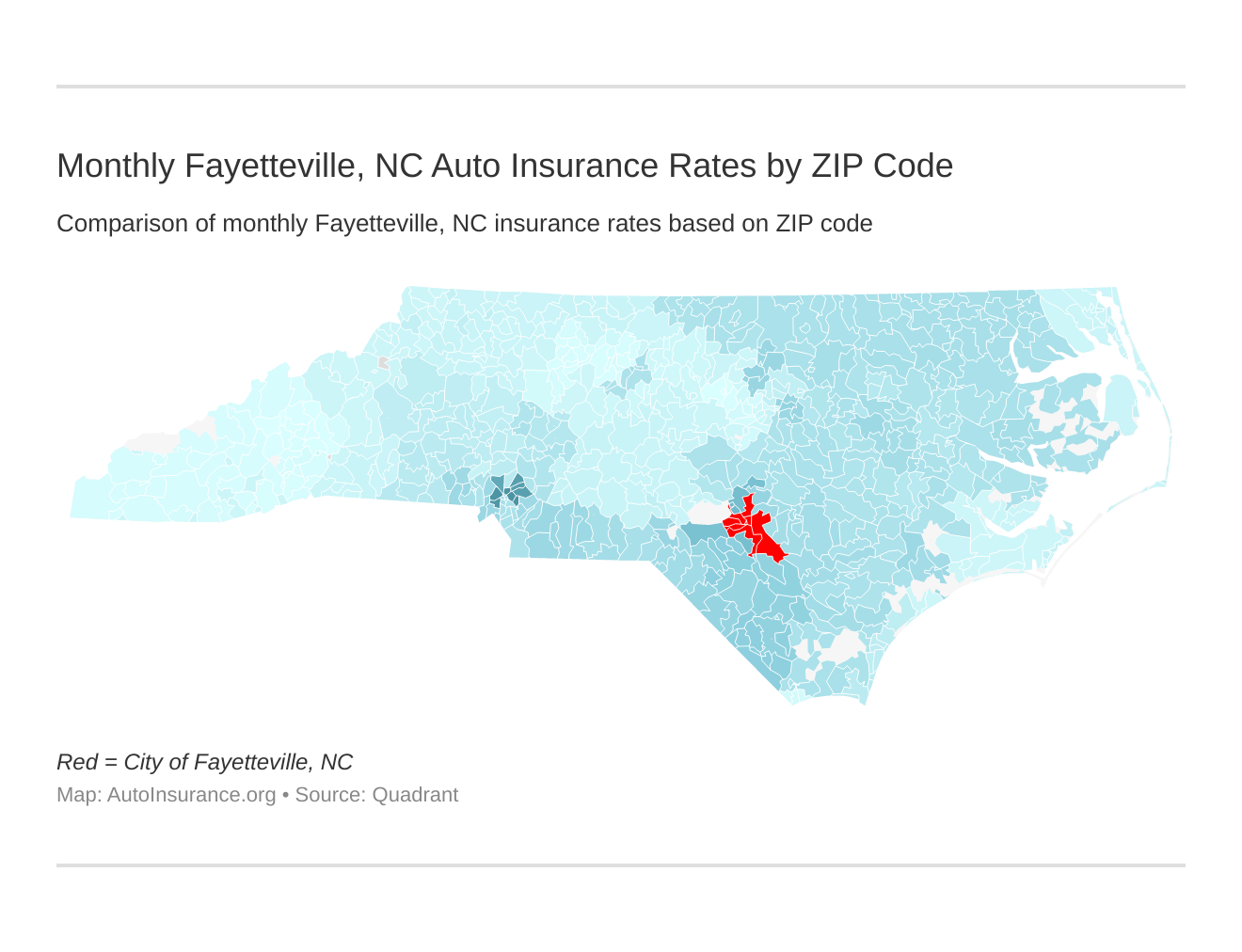

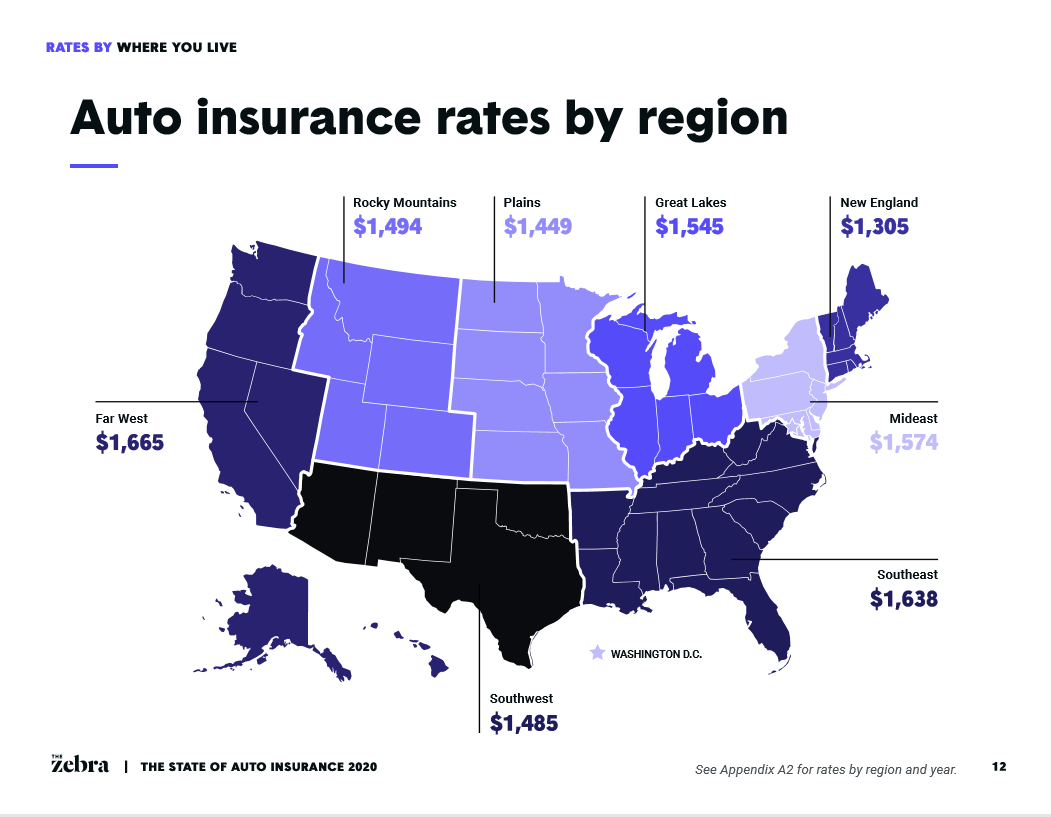

Your ZIP code plays a critical role in determining your auto insurance rate. By comparing insurance rates, you can ensure you’re getting the most value for your money. In this article, you will also find detailed information on the following Įach insurance company uses a unique algorithm to determine your premium, considering factors like your vehicle type, driving record, and location. This comprehensive guide aims to walk you through comparing vehicle insurance rates by ZIP code and introduces you to some of the top insurance comparison sites in 2023. One of the smartest strategies to find the best policy at the best price is by comparing insurance rates. When it comes to buying vehicle insurance, there are many variables to consider. Compare Vehicle Insurance – See the Vehicle Insurance Rates by ZIP Code and Top Insurance Comparison Sites.

0 kommentar(er)

0 kommentar(er)